Every month, there are special occasions like birthdays, anniversaries, and holidays that we eagerly anticipate.

The Tax Day is something that we would all like to omit, though. But there’s an amusing side to this often dreaded affair. You don’t pay your annual taxes on April 18th (the official Tax Day). In actuality, most of the US employees have already withheld enough money from their paychecks throughout the year to cover their yearly taxes by that point. When you file your tax return on Tax Day, all you are doing is informing the IRS of your tax payment status. This is when a 1099 tax calculator might be useful. But what about quarterly taxes? Who needs to pay them and when?

Calculating your quarterly taxes:

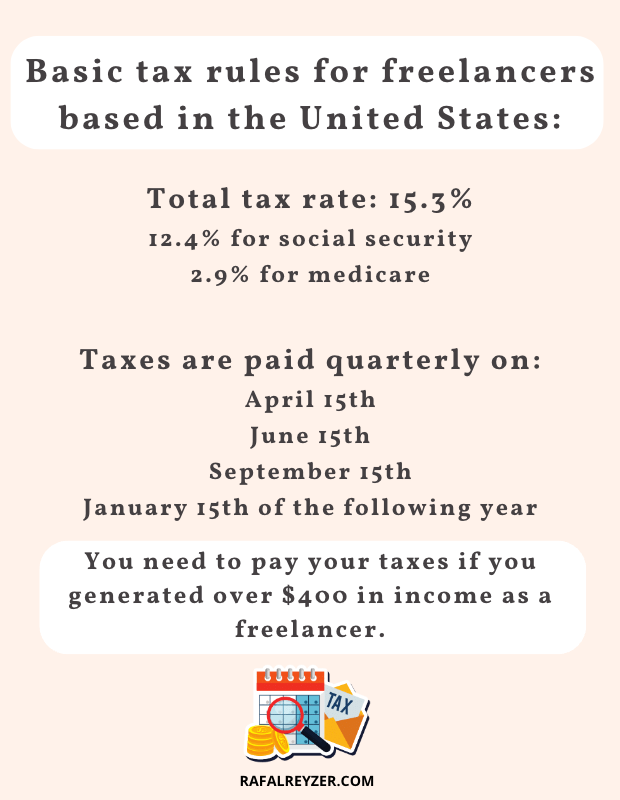

But what happens if you don’t work for a large enough company, which can withhold taxes from your paycheck? You still need to pay federal income taxes to the government, whether you work for yourself as a freelancer or contractor. After all, while the tax obligations associated with freelancing may not be appealing, the flexibility to set your schedule and be your boss is a concept that I’m always trying to promote. When no one is available to withhold your taxes for you, you must submit them on your own to the IRS. If your freelancing income goes above $400 in any year, you must report your income and pay self-employment tax. The IRS collects payments from freelancers referred to as quarterly estimated taxes four times per year. Let’s discuss quarterly taxes in more detail, and talk about who pays them, and how the quarterly tax payment calculator might streamline this procedure.

Taking Quarterly Taxes Into Account

If you are a US citizen who makes money by working for a corporation or as a freelancer, you are required to pay income tax to the federal government. Regular salary earners don’t have to worry about taxes because appropriate amounts have already been taken out of their paychecks by their employers based on the W-4 forms that the employees have filled out. Those who work for themselves need to pay quarterly taxes directly to the government. If that’s you, you don’t have to wait the full year to pay a large amount when filing your annual tax return. In short, if you’re self-employed, you need to pay taxes each quarter.

The estimated quarterly tax payments are due on four specific dates during the year:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

The two parts of quarterly taxes:

As a freelancer or self-employed individual in the U.S., you need to pay a self-employment tax of 15.3% divided into two parts: Social Security and Medicare.

Social Security tax:

The Social Security tax rate is 12.4% of your self-employment income. However, there is a cap on the amount of income subject to Social Security tax, which changes annually. For example, in 2021, the cap was $142,800.

Medicare tax:

This portion of the self-employment tax goes towards the Medicare program, which provides healthcare coverage for individuals aged 65 and older, and differently able younger people. The Medicare tax rate is 2.9% of your self-employment income, with no income cap.

Paying the income tax

At the ordinary income tax rate, it is the total amount of taxes you need to pay per year. The quarterly taxes are known as estimated taxes since when filing them, you only estimate the amount rather than being 100% sure about what your ultimate tax bill will be. If you discover that your completed tax return shows you’ve overpaid through quarterly payments, you can request a refund from the IRS. But if you have underpaid your quarterly taxes, you will be required to reimburse the IRS.

Who is eligible to make quarterly tax payments?

As was already stated, self-employed individuals are required to pay anticipated quarterly taxes. See who gets added to the list of self-employed individuals who are required to file their taxes.

Freelancers:

People who work directly for clients without being employed by a company. Freelancers are those who are paid on an as-needed or as-performed basis, typically for temporary work on a specific project. Independent journalists, for instance, could write a report on a subject that appeals to them personally and then sell it to a magazine or online publication. Independent marketers, graphic designers, content producers, coders video editors, etc. are also included in this category.

Self-employed individuals:

Individuals who work for companies and organizations on a contractual basis are known as independent contractors. They are not entitled to employment benefits because they are not your typical salaried workers. Teachers, actors, musicians, veterinarians, and veterinarians, often find themselves in this category. Owners of small businesses and independent entrepreneurs are also viewed as self-employed.

Here are some parts of income viewed as taxable:

- Rental income

- Gains in wealth

- Pension income

- Increase in the value of company shares

- Dividends earned

- Royalties received

What Day Becomes the Due Date for Quarterly Taxes?

As you already know, quarterly taxes must be paid four times a year, at equal intervals:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

If a public holiday or a Saturday or Sunday happens on the 15th of the month in which the payment is due, the date moves to the next working day. However, it’s essential to keep in mind these 1099 deadlines since missing them might result in fines, and you want to avoid paying taxes with interest. They may even charge you a penalty if you don’t pay enough of the tax obligation by the due date or if you file an annual tax return and are eligible for a refund.

How do you calculate the tax amount for each quarter?

Estimated tax computation is not straightforward. To pay the projected quarterly taxes, you must first estimate your yearly income for the tax year, calculate your overall income using the tax rate, deduct any permissible costs as determined by the IRS, and then divide your entire tax liability into four equal installments. Even a small error might result in a fine, thus you must proceed carefully with your calculations. Self-employment taxes, often known as SECA taxes, must also be taken into consideration.

Conclusion

By using automation and technology, you may minimize human mistakes in the tax calculation process. You can easily manage all of your deductions and correctly calculate all of your taxes that make up quarterly tax payments. An AI-powered tax engine is the most precise and efficient calculator for self-employed and independent contractors’ quarterly tax payments. FlyFin streamlines the tax preparation process by allowing you to connect all of your spending accounts. But if you have any doubts at all about your tax situation, please get in touch with a tax professional who can help you out. Next up, you may want to explore a guide on tech staff augmentation.

Get your free PDF report: Download your guide to 80+ AI marketing tools and learn how to thrive as a marketer in the digital era.

Hey there, welcome to my blog! I'm a full-time entrepreneur building two companies, a digital marketer, and a content creator with 10+ years of experience. I started RafalReyzer.com to provide you with great tools and strategies you can use to become a proficient digital marketer and achieve freedom through online creativity. My site is a one-stop shop for digital marketers, and content enthusiasts who want to be independent, earn more money, and create beautiful things. Explore my journey here, and don't miss out on my AI Marketing Mastery online course.